Merchant of Record — What is it and why do you need to know?

Author

Date

Category

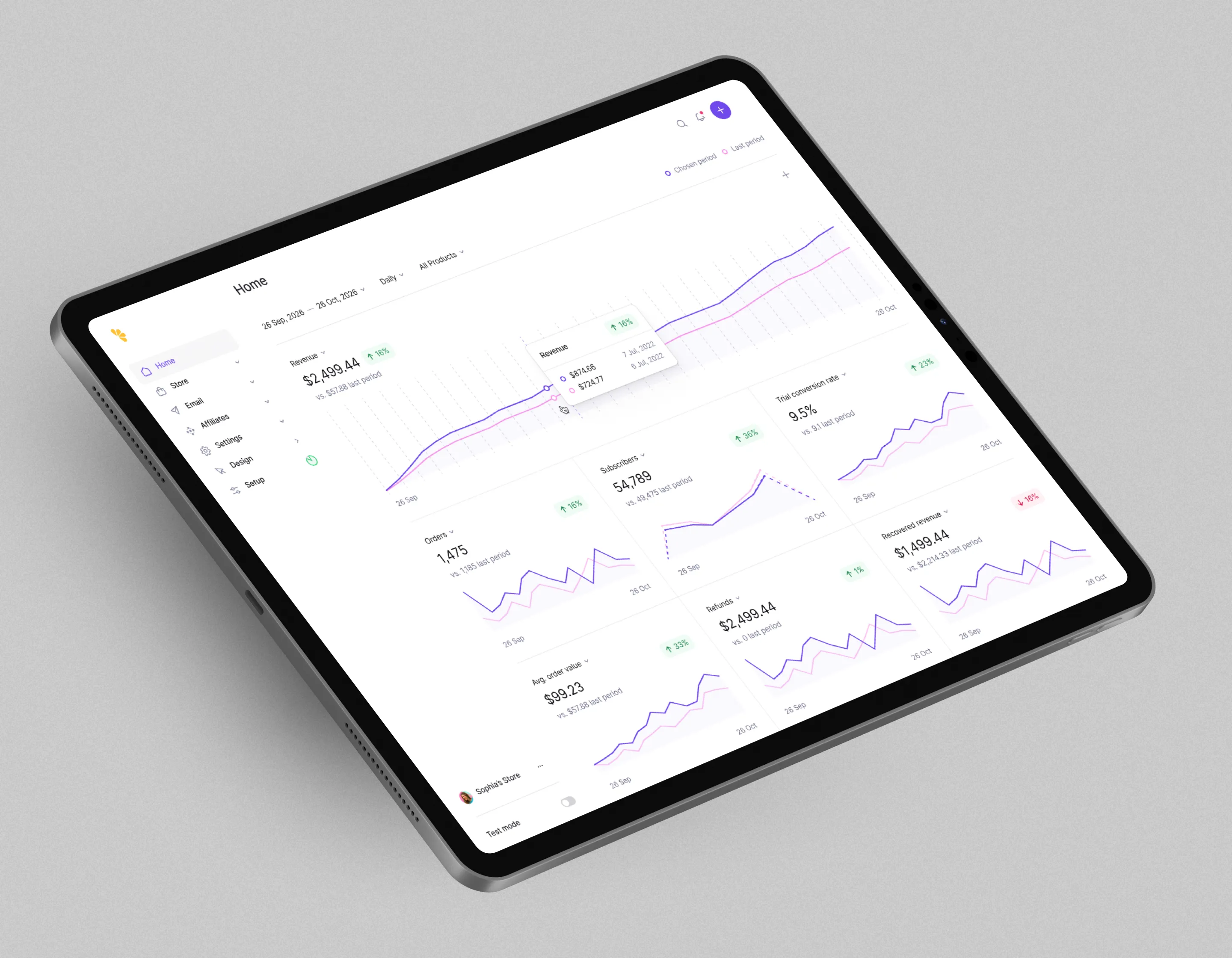

If you're looking for a merchant of record, look no further than Lemon Squeezy. Rated #1 and trusted by thousands of SaaS businesses, founders, startups, and digital creators across 100+ countries. Sign up today for a free account today!

So you've set up an online business and are ready to accept online payments.

But before you can do this, you'll need to set up a merchant account for your business and decide if you will manage all the payment administration yourself or outsource it to a merchant of record (MoR).

A business's merchant of record will take on financial liability for those transactions, including processing refunds and collecting taxes. These processes can become complex when your product is sold in different countries. Without a good MoR, processing transactions can become quite a headache.

Sounds scary? Don't panic—we're here to help.

In this article, we'll explain what a merchant of record is, how it works, and how to find the perfect solution for your business.

What Is a Merchant of Record (MoR)?

A merchant of record is an entity that accepts payments on behalf of a business. It's authorized and held liable for these transactions by a bank or other type of financial institution.

Your business can have its own merchant account or business bank account, or it can use a third-party merchant account. Having a merchant account is essential if you want your business to be able to process debit and credit card payments.

There are many technical aspects that an MoR can handle, including:

- Processing payments.

- Managing all payment processor fees.

- Dealing with financial institutions.

- Managing refunds and charge-backs.

- Providing billing-related customer support.

- Ensuring that your business remains compliant.

- Maintaining financial liability for your transactions.

The merchant of record's name is what customers will see on their bank statements, as it holds the processed amount for a short while before it is transferred to the business.

You can be your own merchant of record for your business, which means you will be responsible for accepting online payments, issuing refunds, and remaining compliant with the applicable laws. You'll also need to resolve payment disputes directly with customers, deal with currency conversion, and more.

Imagine a customer in India buys a subscription to your SaaS product for a year, but then decides that they want a refund after a month. You'd need to liaise with the customer in a different time zone, calculate the amount of money to refund, deal with the currency conversion, and process the transaction.

Or, what happens if your customer's card is used fraudulently and the bank issues a charge-back? This can start a lengthy process, and you'll need to decide whether to accept or fight the charge-back.

An alternative option is to use a third-party service like Lemon Squeezy to act as your MoR.

A third-party payment solution takes on all financial responsibility for the company's online transactions, collects the required taxes, and deals with disputes.

They will communicate directly with customers, and their details will appear on customer invoices, leaving you free to run your business with fewer distractions.

Lots of different types of businesses can benefit from a third-party MoR solution.

For example, a SaaS organization that sells its products in other regions, each with its own financial and legal administrative requirements, could use an MoR to ensure it remains compliant.

What’s the Difference between a Merchant of Record and Other Payment Solutions?

Deciding on the best solution can seem like a daunting task since there are a few different options. Below we explore them in more detail.

Hosted gateway

Using a hosted gateway is when you integrate a third party into your website and give them the authority to process payments on your behalf.

The third party becomes your merchant of record and takes on all of the associated risks.

Services like Lemon Squeezy provide hosted gateways for your business and offer security, tax compliance, and fraud protection.

When a customer makes a payment on a site with a hosted gateway, they will be redirected to the service provider's site to fill in their payment details.

Hosted gateways are user-friendly and easy to set up. However, it's important to note that since they redirect your customers to another site to make payments, you won't be able to fully control your customers' experience

API-hosted payment gateway

API-hosted gateways use an application programming interface (API) to handle payment details and processing on the merchant’s website.

This type of solution allows payments through the website, which is ideal for those who want complete control over their website design and user experience.

It is fully customizable and can be easily integrated with all mobile devices, creating a smooth buying experience for the customer.

However, if you choose this gateway type, you will be responsible for security and compliance. You'll need to pay for an SSL certificate and ensure that your transaction process is PCI DSS-compliant.

Self-hosted payment gateway

Self-hosted payment gateways fall somewhere between hosted and non hosted gateways. Payment details are collected directly on the merchant's site, giving them more control over the user experience.

Those details are encrypted and sent to a third party for authorization, but the customer is not redirected.

Shopify and Stripe are good examples of self-hosted payment gateways, and they enable faster transactions because no site redirection is necessary.

The downside is that, unlike hosted gateways, this type of solution does not offer the technical support a less technical business may need. If something goes wrong, you'll need to figure it out or contract an expert to fix it.

Non hosted gateway

Non hosted gateways give the merchant full control over payment processing and user experience on their site.

If you choose this option you’ll be the merchant of record, and you’ll be responsible for any liabilities that may occur with your transactions.

You’ll also need to make sure you stay compliant with all the relevant laws, which can be challenging if you’re selling your product globally.

Even if your geographical range is smaller, compliance regulations can change rapidly.

Although large companies tend to be their own merchant of record, it’s often much easier for small and medium-sized businesses to hire a third-party service to act as their MoR.

Merchant of Record vs. Seller of Record (SoR)

The term merchant of record is often confused with seller of record, so it's essential to understand the difference between the two.

The MoR is a third-party payment processor for the original business.

They don't take on the identity of the business they are acting as MoR for; their name will identify them in customer transactions and receipts.

By contrast, the record seller assumes the original business's identity. It will use the company’s name and identify itself as the actual seller.

It will also take on all financial liabilities and be responsible for the brand's reputation.

Merchant of Record vs. Payment Service Provider (PSP)

Some businesses decide to use a payment service provider (PSP) — for example, Stripe or PayPal, rather than a merchant of record.

Payment service providers allow you to accept payments from multiple credit and debit cards, and act as the go-between for your business and the banks or financial institutions providing the funds.

The critical difference between MoRs and PSPs is that payment service providers only handle payment processing.

In contrast, a merchant of record will take responsibility for tax calculations, financial risks, regulations, the orders, and process credit card payments.

Benefits of Partnering with a Merchant of Record

For many online businesses, a merchant of record is the best solution. Let’s take a look at some of the key advantages below.

Keep your brand PCI-compliant

An MoR is responsible for ensuring that your business remains compliant with the Payment Card Industry Data Security Standards (PCI DSS).

The PCI DSS regulation ensures that companies handle credit card data securely, and includes firewalls, encryptions, antivirus software, and more.

Manage fraudulent purchases

Online businesses need robust protection against fraudulent transactions, and most MORs are well equipped to provide this. They can prevent, detect, and flag potentially fraudulent activity and review any issues for you.

MoR services typically have an entire team dedicated to managing risk and fraud, carrying out additional security checks, and investigating suspicious activity.

Manage refunds

Anyone who sells products or services will know that dealing with refunds and disputes can be a real pain.

Since MoRs act as resellers, they assume responsibility for all payments, including disputes and refunds, leaving you free to focus on the more enjoyable aspects of running a business.

Handle tax (VAT) collection and remittances

Tax collection and remittance (paying taxes to the government) can be incredibly complex for business owners—particularly when your product is being purchased in different countries.

Luckily, a good MoR will handle all the paperwork and ensure your business complies with global tax regulations.

Support expansion into global markets

If you want to sell your product internationally, your platform must be localized and adapted to each country's currency and financial regulations. As you can imagine, this can be a lengthy and costly process if you try to manage it yourself.

By contrast, an MoR will automatically localize and customize the transaction process for your customers, making selling your product internationally a breeze.

Help businesses scale

An MoR allows you to focus on growing your business by freeing up time spent on administrative tasks.

Using an MoR will ensure that you remain compliant while selling in different countries, and it can open up your business to an exciting international market.

How the Merchant of Record Model Works (In 5 Steps)

Here's how the MoR model works when a customer purchases a product:

- The customer initiates the purchase on the merchant's website and is redirected to the checkout page, which the MoR hosts.

- When the customer makes their payment, a single transaction occurs between the customer and the MoR.

- The MoR passes the right of use ownership for the product from the merchant to the customer.

- The transaction usually appears on the customer's credit card statement with either the website's name, or a combination of the merchant and the MoRs' names.

- Any post-sale disputes, such as refunds or charge-backs, will be dealt with by the MoR.

Factors to Consider When Selecting the Best Solution for Your Business

Choosing the right payment solution for your business is critical, and you should consider all options carefully. Here are a few things to keep in mind when doing your research.

Security

Internet security should be top of your list when choosing a payment solution. Check that the provider is PCI DSS-compliant and that they have been approved by your local financial regulator or the central bank.

You should also check that they use an SSL (secure sockets layer) certificate to ensure that your customers' confidential information is encrypted.

Integrations

Look for payment solutions that are easy to integrate into your existing processes and website design. Most are easy to set up and use, and you won't need any coding experience.

Choose a service that supports multiple payment methods and is user-friendly. Test-drive it or read reviews to ensure it will keep the payment process going, as you're likely to lose customers if it's too clunky.

Support

Consider the level of support your business requires, particularly in dealing with payment issues.

Some solutions will handle all customer disputes and refunds on your behalf, whereas others may not provide this service.

Choose a provider that is available 24/7 by phone, email, and chat to resolve any issues quickly and efficiently.

Ease of Use

Make sure you pick an easy solution for you and your customers to navigate. Most providers are designed to be easy to use and manage, and you should be able to get them up and running almost instantly.

Think about your customers' experience too, and choose a solution that makes the payment process as straightforward as possible.

Not to mention, Lemon Squeezy offers currency support and flexible payout methods.

An MoR Is the Perfect Solution for All Types of Businesses

SaaS Companies

If you sell software as a service, your products can be purchased by anyone with an internet connection. By enabling you to handle international payments, taxes, and compliance in different countries, an MoR can help your business to become a key player in the global market.

eCommerce or Direct to Consumer Businesses

eCommerce and D2C businesses can use an MoR to simplify selling across borders. A merchant of record enables you to sell your product or service across borders without needing a local office or bank account.

Gated Content or Digital Downloads

Companies that sell access to gated content or digital downloads such as academic papers, games, or eBooks, have a global customer base.

A good MoR can ensure that your customers have a seamless sale, regardless of their location.

Wrapping Up

If you're selling any product online, you'll need a merchant of record to process your transactions. Although there are a few different solutions to choose from, an MoR service is the best solution for many businesses.

Here's why:

- It deals with tax, currency conversions, and compliance, so you don't have to worry about it.

- It simplifies the payment process for your business and customers, providing a smooth user experience.

- It opens your business to a global market, allowing you to scale and reach a new customer base.

Merchant of Record FAQs

What is the purpose of a merchant of record?

The MoR is responsible for processing payments online and ensuring compliance with legal and information security requirements.

Is PayPal a merchant of record?

No, PayPal is a payment service provider (PSP).

A PSP generally only handles payment processing, whereas an MoR takes responsibility for the entire order process, including:

- Tax calculations.

- Financial risks.

- Regulations.

- Compliance.

Which types of business require a merchant of record?

Any business that sells products online (whether physical or digital) needs an MoR to process payments made on the internet.

Lemon Squeezy Can Help Your Business to Grow

Lemon Squeezy’s MoR service takes care of the payment process on your behalf so that you can focus on scaling your business.

Give Lemon Squeezy a Try — It’s Free to Get Started

Whatever stage of your journey, we’re here to help

No matter the stage of your company, we stand behind our promise to provide exceptional customer support, from initial setups to massive migrations and everything in between.

Invest in your business with peace of mind that we're here for you whether you need technical help or business advice.

Creator Guide

Looking for some advice on how to sell and market your digital products? Download the creator’s guide to dive deep into getting your idea off the ground.

Merchant of Record Guide

Free guide for all entrepreneurs and organizations explaining why partnering with a Merchant of Record is more important than you might realize.

Want merch?

Want some fresh Lemon Squeezy swag with all the lemon puns you could ever imagine? The wait is almost over as we’re gearing up for a limited-time merch drop.

Book a demo today and get your own personal guided tour of Lemon Squeezy

Still have questions about Lemon Squeezy? Book a call with our sales team today and we’ll show exactly how we can revolutionize the way your business handles global payments and sales tax forever.

Need help?

If you’re looking to get in touch with support, talk to the founders, or just say hello, we’re all ears.