Get your SaaS company ready for Sales Tax in The US

Author

Date

Category

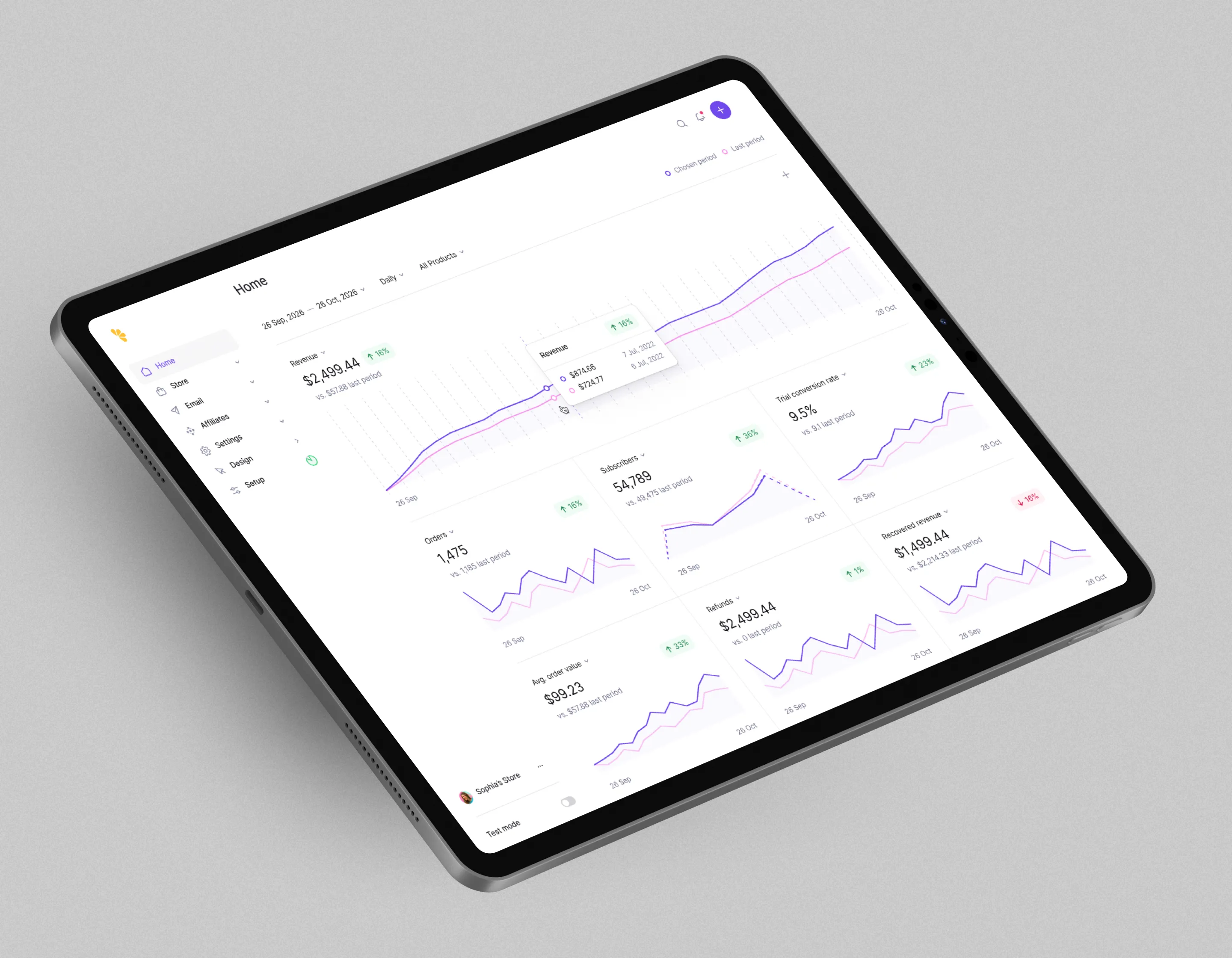

Never worry about sales tax headaches with Lemon Squeezy. As the leading merchant of record for 1,000's of software companies, we keep your business compliant with sales tax so you can focus on your business.

The United States is the only major economy that doesn’t have a value-added tax (VAT). Instead, it relies on sales tax, a levy imposed on businesses selling products and services to its citizens.

However, navigating this taxation system is far from straightforward—especially for software as a service (SaaS) companies.

Each state has its own set of rules, which is further complicated by additional regulations at the county and city levels. In total, there are more than 13,000 jurisdictions to consider.

Failing to adhere to these tax laws can lead to severe consequences. This can result in substantial fines in some states, while others even impose prison sentences.

To understand how your SaaS company can effectively apply sales tax and stay on the right side of the law, keep reading.

How to Classify SaaS Products

A SaaS business provides software that people can use on their computers from anywhere in the world. These services are typically billed on a subscription basis or according to the frequency of product usage.

This includes project management tools (think Trello or Asana) or money management software (like Xero, Sage, or even Lemon Squeezy).

With the sudden emergence of SaaS companies, tax authorities are still figuring out how to apply sales tax to them. Unlike brick-and-mortar stores, which sell goods, or electricians, who provide a service, SaaS businesses straddle a line between the two concepts — product and service.

Even though they're referred to as a "service," the software they provide is sometimes seen as a product.

This means that, on top of navigating a complicated sales tax system in the U.S., SaaS businesses need to pay extra attention to how tax authorities classify their business.

Tangible vs. Intangible Personal Property

Tax authorities use the terms “tangible” to describe physical products and “intangible” to describe nonphysical assets or services.

Let’s say you have a SaaS business that specializes in human resource software, which allows users to book and approve leave and manage their company’s disciplinary processes.

If, for example, your business has customers in the state of California, you need to consider the following in terms of SaaS sales tax:

- Nature of access: If your HR software evolves over time, such as through regular software updates, it might fall under the classification of an intangible service. In California, SaaS products are often treated as non-tangible property due to their digital nature, which requires frequent updates. On the other hand, if your software doesn't need continuous external support, it may be seen as a tangible product.

- Delivery method: In California, it’s important to distinguish between downloadable software and cloud-based services. If your HR software is downloadable, you may be subject to SaaS sales tax as tangible personal property because it exists on users' computers, similar to physical items like books and lamps in their homes. On the other hand, if it operates solely in the cloud, California’s tax laws may categorize it differently, recognizing its intangible nature.

- Payment model: You also need to take into account how your product is purchased. A subscription model implies an ongoing service, which may be considered intangible personal property. On the other hand, if your HR software is a one-off purchase, it may be classified as tangible personal property.

As a SaaS taxable business owner, you need to be aware of each of these laws to ensure compliance in the states that your company is active in.

How Sales Tax Laws Are Generally Applied in the U.S.

Sales tax is a type of consumption tax that is levied on the purchase of goods and services. From an economic perspective, this aims to reduce spending, which may encourage saving and investing.

Sales tax laws exist in 46 U.S. states that do not include Delaware, New Hampshire, Oregon, and Montana. Of these states, 24 tax SaaS services and—if your customers need to download the software—this number increases to 31.

Have a look at the map below, which outlines where SaaS products are taxed:

Cities and counties may also have additional sales taxes. When you calculate the overall sales tax, you then need to consider both the state sales tax and local tax laws, which are added together.

For example, let’s return to your human resource software. If your SaaS business has customers in California, the state imposes a base sales tax rate, which is currently 6%.

However, many counties in California add their own sales tax. Let’s say your customer is in Santa Clara County, which has a 0.25% county sales tax.

This means that your overall sales tax rate in Santa Clara County may be the state sales tax (6%), plus the local county sales tax (0.25%), resulting in a total of 6.25%.

Depending on the city and local government that your customer falls under, this number may increase by a further 3.625%. In fact, in Santa Clara County, you can expect a maximum sales tax rate of 9.875%.

This illustrates the importance of understanding both the state and local sales tax rates to calculate the total sales tax for your SaaS product.

Overlooking even one jurisdiction can distort your figures, leading to either undercharging or overcharging.

When it comes to overcharging, your business will have to bear the brunt of the financial loss, since the transaction with your customers is concluded and cannot be amended retroactively.

Overcharging not only risks upsetting customers but could also lead to investigations by tax authorities, who may suspect it as intentional tax fraud.

Additional Sales Tax Considerations for SaaS Products

Now that you have a good grasp of basic sales tax obligations, let’s have a look at how different regions determine their numbers:

1. Economic nexus

Wayfair, a Boston-based e-commerce company, was conducting significant business in several states, despite not having a physical presence in them.

Some states, such as South Dakota, were unhappy about this. They believed that it gave out-of-state businesses, such as Wayfair, an unfair advantage over local stores that were forced to charge sales tax.

To remedy the situation, South Dakota decided to impose sales tax laws on companies that made more than a certain number of sales or transactions in their state.

Wayfair took them to court for this decision. However, in 2018, the United States Supreme Court ruled that businesses with more than 200 transactions or $100,000 of in-state sales are liable to pay sales tax in that state.

Although this was in terms of an e-commerce business, the same applies to SaaS businesses.

Today, if you surpass a certain threshold in a state you establish an “economic nexus.” As soon as your business achieves this status, you must apply for a sales tax permit and, once approved, you have to collect and pay sales tax.

2. B2B vs. B2C

Unlike VAT, which is applied to goods and services throughout the production process, sales tax is only collected once.

In the U.S., this is usually applied at the point of sale. For instance, if a wholesaler sells canned fish to a retailer, they don’t usually pay sales tax on the transaction.

However, when the retailer sells the canned fish to end consumers, sales tax laws are applied at the point of sale. Similarly, in the context of SaaS products, sales tax is typically incurred only when there is a direct transaction with end customers. This means that if SaaS companies sell their custom software directly to consumers (B2C transactions), sales tax is applicable.

However, if they sell their software to other businesses (B2B transactions), the sales tax implications may differ. In some cases, exemptions or reduced rates may apply, depending on the jurisdiction and the nature of the transaction.

3. Sales tax sourcing

Sales tax can either be applied at the origin or destination of a transaction. Sourcing rules help businesses determine the right tax area, which then decides the sales tax rates and rules they need to follow. There are two ways to approach this:

- Origin-based sourcing: Here, the sales tax is based on the location of the seller or sale’s point of origin. In other words, the tax rate is determined by the seller's location or the business’s location.

- Destination-based sourcing: In contrast, destination-based sourcing is determined by the location of the buyer or the destination of the product or service. The sales tax is applied based on where the buyer is located or where the product is delivered.

For sales tax on SaaS products, the sourcing rules can vary based on the nature of the transaction and the specific regulations of the jurisdiction.

Some jurisdictions may apply origin-based sourcing, considering the location of the SaaS provider or the server, while others may use destination-based sourcing, focusing on the location of the end-user.

Let’s return to our HR example. Instead of being based in California, let’s say your business is now operating from Nebraska.

The table below outlines which states rely on origin-based or destination-based sales tax:

From this, you see that Nebraska relies on destination-based sales tax.

If your HR software gains subscribers in a state such as North Dakota, you have to remit the corresponding sales tax to that state. This includes:

- Determining the appropriate tax rate.

- Collecting the tax from subscribers.

- Remitting the collected amount to the North Dakota tax authorities.

This ensures that the sales tax you collect reaches the correct tax authority.

A Step-by-Step Guide to Sales Tax Compliance

If you want your SaaS business to succeed in the U.S., you need to pay special attention to the sales taxes that apply to your company in every jurisdiction.

To get you started on a path toward sales tax compliance, follow these steps:

Step 1: Determine nexus and taxability

Your first step is to figure out which states you have an economic nexus in.

Each state has a different economic nexus threshold for this. For example, in Georgia, the threshold is $100,000 or 200 sales, while in Mississippi, you’re only liable after $250,000.

To determine where your business has a sales tax nexus, you need to calculate your sales volume and the number of transactions in each state. This is also a good time to consider whether you’re selling your software to another business or directly to your end user.

If your company is based outside of the U.S., you won’t have to worry about origin-based sales tax. Instead, you should consider destination-based sales tax and any relevant international tax regulations.

Step 2: Register with state and local tax authorities

Once you know where your company is liable for economic nexus, as well as any other taxes, you need to register with the relevant tax authorities.

This may include both local and state tax authorities—make sure you don’t skip any of them. You can download the necessary forms and sales tax permits from the online portals of each tax authority. This will allow you to legally collect sales tax.

If you previously missed any taxes, you can file for back taxes. The majority of states offer voluntary disclosure agreements (VDA), which allow you to declare any missed taxes without being harshly penalized.

Step 3: Configure your billing system

As a professional SaaS company, you likely rely on billing software to keep track of your income and expenses.

Once you become liable for tax in the U.S. market, you need to adjust your billing systems to accurately calculate your tax burden.

Don’t have billing software yet?

We’ve got you covered. At Lemon Squeezy, we make business finances a breeze. Contact us to find out how we can help you.

Step 4: Collect and remit SaaS sales tax

Once everything is in place, you can start collecting sales tax from your customers.

Make sure you display the tax amounts on all your invoices and establish a process for timely remittance to each tax authority.

Step 5: Stay informed

If you manage sales tax for your company, you need to stay up to date on evolving tax laws and regulations.

In the end, it’s your responsibility to make sure you remain tax-compliant. You can’t claim ignorance when the authorities track you down.

Always remain proactive and quickly adapt to new tax laws before hefty fines eat at your profits

Need a Complete Saas Sales Tax Solution? Use a Merchant of Record (MoR)

If you’re feeling uncomfortable about your tax liability in the U.S.—or anywhere else, for that matter—you can easily outsource this task to us.

At Lemon Squeezy, we operate as a merchant of record. This means that we calculate, collect, and remit all your taxes so that you can focus on your business. On top of this, we can also manage your payments, subscriptions, refunds, tax fraud prevention, multi-currency support, and much more.

For example, one of our clients, Typing Mind, was struggling to keep abreast with their sales tax. We stepped in, took over this task, and left them with a 300% increase in monthly recurring revenue (MRR).

We believe you should have the time and space to grow your business rather than worrying about tax compliance in over 11,000 jurisdictions—in the U.S. alone!

Learn more about how Lemon Squeezy can take care of your tax compliance, giving you peace of mind as we handle all sales tax, payments, and compliance for merchants globally.

Whatever stage of your journey, we’re here to help

No matter the stage of your company, we stand behind our promise to provide exceptional customer support, from initial setups to massive migrations and everything in between.

Invest in your business with peace of mind that we're here for you whether you need technical help or business advice.

Creator Guide

Looking for some advice on how to sell and market your digital products? Download the creator’s guide to dive deep into getting your idea off the ground.

Merchant of Record Guide

Free guide for all entrepreneurs and organizations explaining why partnering with a Merchant of Record is more important than you might realize.

Want merch?

Want some fresh Lemon Squeezy swag with all the lemon puns you could ever imagine? The wait is almost over as we’re gearing up for a limited-time merch drop.

Book a demo today and get your own personal guided tour of Lemon Squeezy

Still have questions about Lemon Squeezy? Book a call with our sales team today and we’ll show exactly how we can revolutionize the way your business handles global payments and sales tax forever.

Need help?

If you’re looking to get in touch with support, talk to the founders, or just say hello, we’re all ears.